Federal Credit Union: Reputable and Safe Banking in Wyoming

Federal Credit Union: Reputable and Safe Banking in Wyoming

Blog Article

The Ultimate Guide to Recognizing Cooperative Credit Union

Credit rating unions stand as unique financial entities, rooted in concepts of common support and member-driven operations. Past their fundamental worths, understanding the complex functions of debt unions includes a much deeper expedition. Unwinding the intricacies of membership eligibility, the evolution of solutions used, and the distinct advantages they bring calls for a comprehensive exam. As we navigate through the details of lending institution, an insightful journey waits for to lose light on these member-focused institutions and how they vary from traditional banks.

What Are Credit Rating Unions?

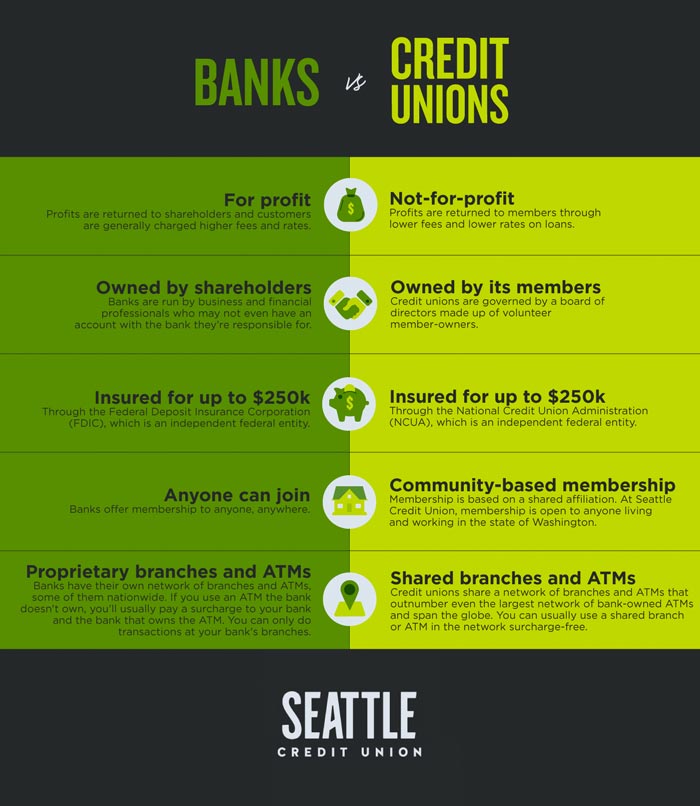

Credit score unions are member-owned banks that use a variety of financial solutions to their members. Unlike standard financial institutions, lending institution run as not-for-profit companies, suggesting their key emphasis gets on offering their members rather than taking full advantage of revenues. Participants of a cooperative credit union commonly share a typical bond, such as functioning for the same company, belonging to the exact same community, or belonging to the very same organization.

Among the essential benefits of credit report unions is that they typically offer higher rates of interest on interest-bearing accounts and lower rates of interest on financings contrasted to financial institutions. This is because cooperative credit union are structured to profit their participants straight, permitting them to pass on their earnings in the kind of better rates and fewer charges. Additionally, cooperative credit union are understood for their individualized customer care, as they focus on constructing connections with their members to understand their one-of-a-kind economic requirements and goals.

Background and Development of Lending Institution

The origins of member-owned financial cooperatives, understood today as lending institution, trace back to a time when communities looked for alternatives to typical financial institutions. The idea of lending institution come from the 19th century in Europe, with Friedrich Wilhelm Raiffeisen commonly credited as the pioneer of the cooperative financial motion (Cheyenne Federal Credit Union). Raiffeisen started the first recognized lending institution in Germany in the mid-1800s, highlighting area support and self-help principles

The development of lending institution continued in North America, where Alphonse Desjardins established the first cooperative credit union in Canada in 1900. Shortly after, in 1909, the first U.S. cooperative credit union was formed in New Hampshire by a team of Franco-American immigrants. These early lending institution operated the fundamental principles of shared aid, democratic control, and participant possession.

In time, cooperative credit union have actually grown in popularity worldwide as a result of their not-for-profit structure, concentrate on serving participants, and offering competitive financial products and solutions. Today, cooperative credit union play an important function in the monetary market, offering available and community-oriented financial alternatives for businesses and people alike.

Subscription and Qualification Criteria

Membership at a credit history union is normally restricted to individuals fulfilling certain qualification standards based upon the institution's starting concepts and governing requirements. These standards frequently include aspects such as geographical place, work condition, membership in particular companies, or affiliation with particular groups (Credit Unions Cheyenne WY). Credit history unions are understood for their community-oriented method, which is shown in their membership needs. As an example, some credit history unions might just serve people who work or live in a specific location, while others might be customized to staff members of a specific company or participants of a particular association.

Additionally, cooperative credit union are structured as not-for-profit organizations, indicating that their primary goal is to offer their members as opposed to generate profits for shareholders. This focus on participant solution usually converts into even more tailored interest, reduced costs, and affordable passion rates on cost savings and financings accounts. By meeting the qualification standards and ending up being a member of a cooperative credit union, individuals can access a variety of monetary product or services customized to their details needs.

Solutions and Products Supplied

Among the vital facets that sets debt unions apart is the diverse variety of financial services and products they use to their members. Cooperative credit union generally offer standard banking solutions such as cost savings and checking accounts, financings, and bank card. Participants can likewise gain from financial investment solutions, consisting of pension and monetary planning assistance. Lots of lending institution offer competitive interest prices on savings accounts and fundings, in addition to reduced costs compared to standard banks.

Additionally, cooperative credit union often give convenient online and mobile financial options for members to conveniently handle their funds. They might provide advantages such as common branching, permitting members to access their accounts at other credit score unions throughout the nation. Some lending institution also supply insurance items like home, life, and vehicle insurance coverage to help participants shield their possessions and enjoyed ones.

Along with monetary solutions, lending institution regularly take part in neighborhood outreach programs and economic education campaigns to sustain their participants in achieving their monetary goals.

Advantages of Financial With Cooperative Credit Union

When thinking about monetary establishments, discovering the advantages of financial with credit unions exposes special advantages for members looking Credit Unions in Wyoming for tailored service and competitive rates. Unlike large financial institutions, credit history unions are member-owned and prioritize building solid partnerships with their participants. In general, financial with a credit scores union can give an extra customized, affordable, and member-centric monetary experience.

Verdict

Credit history unions are member-owned financial organizations that offer a range of banking solutions to their members. The concept of credit score unions stem in the 19th century in Europe, with Friedrich Wilhelm Raiffeisen frequently credited as the leader of the cooperative financial movement.The advancement of credit history unions proceeded in North America, where Alphonse Desjardins established the first credit scores union in Canada in 1900. Credit scores unions typically provide typical financial services such as financial savings and checking accounts, car loans, and credit history cards.When taking into consideration monetary establishments, checking out the advantages of financial with debt unions reveals special advantages for members looking for individualized service and competitive rates.

Report this page